A) $3,089

B) $3,251

C) $3,422

D) $3,602

E) $3,782

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because your mother is about to retire, she wants to buy an annuity that will provide her with $75,000 of income a year for 20 years, with the first payment coming immediately.The going rate on such annuities is 5.25%.How much would it cost her to buy the annuity today?

A) $825,835

B) $869,300

C) $915,052

D) $963,213

E) $1,011,374

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose People's bank offers to lend you $10,000 for 1 year on a loan contract that calls for you to make interest payments of $250.00 at the end of each quarter and then pay off the principal amount at the end of the year.What is the effective annual rate on the loan?

A) 8.46%

B) 8.90%

C) 9.37%

D) 9.86%

E) 10.38%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your investment advisor has recommended your invest in bonds that pay 6.0%, compounded annually.If you invest $10,000 today, how many years will it take for your investment to grow to $30,000?

A) 12.37

B) 13.74

C) 15.27

D) 16.97

E) 18.85

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

As a result of compounding, the effective annual rate on a bank deposit (or a loan) is always equal to or greater than the nominal rate on the deposit (or loan).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your aunt wants to retire and has $375,000.She expects to live for another 25 years and to earn 7.5% on her invested funds.How much could she withdraw at the end of each of the next 25 years and end up with zero in the account?

A) $28,843.38

B) $30,361.46

C) $31,959.43

D) $33,641.50

E) $35,323.58

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a bank compounds savings accounts quarterly, the nominal rate will exceed the effective annual rate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The greater the number of compounding periods within a year, then (1) the greater the future value of a lump sum investment at Time 0 and (2) the smaller the present value of a given lump sum to be received at some future date.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your Aunt Elsa has $500,000 invested at 6.5%, and she plans to retire.She wants to withdraw $40,000 at the beginning of each year, starting immediately.What is the maximum number of whole payments that can be withdrawn before the account is exhausted, i.e., before the account balance would become negative? (Hint: Round down to the nearest whole number.)

A) 18

B) 19

C) 20

D) 21

E) 22

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Some of the cash flows shown on a time line can be in the form of annuity payments, but none can be uneven amounts.

B) A time line is not meaningful unless all cash flows occur annually.

C) Time lines are not useful for visualizing complex problems prior to doing actual calculations.

D) Time lines cannot be constructed in situations where some of the cash flows occur annually but others occur quarterly.

E) Time lines can be constructed for annuities where the payments occur at either the beginning or the end of the periods.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you inherited $275,000 and invested it at 8.25% per year.How much could you withdraw at the beginning of each of the next 20 years?

A) $22,598.63

B) $23,788.03

C) $25,040.03

D) $26,357.92

E) $27,675.82

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a Google.com bond will pay $4,500 ten years from now.If the going interest rate on safe 10-year bonds is 4.25%, how much is the bond worth today?

A) $2,819.52

B) $2,967.92

C) $3,116.31

D) $3,272.13

E) $3,435.74

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

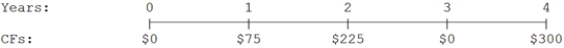

At a rate of 6.5%, what is the future value of the following cash flow stream?

A) $526.01

B) $553.69

C) $582.83

D) $613.51

E) $645.80

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have just purchased a U.S.Treasury bond for $747.25.No payments will be made until the bond matures 5 years from now, at which time it will be redeemed for $1,000.What interest rate will you earn on this bond?

A) 4.37%

B) 4.86%

C) 5.40%

D) 6.00%

E) 6.60%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You just deposited $2,500 in a bank account that pays a 4.0% nominal interest rate, compounded quarterly.If you also add another $5,000 to the account one year (4 quarters) from now and another $7,500 to the account two years (8 quarters) from now, how much will be in the account three years (12 quarters) from now?

A) $15,234.08

B) $16,035.88

C) $16,837.67

D) $17,679.55

E) $18,563.53

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering two equally risky annuities, each of which pays $15,000 per year for 20 years.Investment ORD is an ordinary (or deferred) annuity, while Investment DUE is an annuity due.Which of the following statements is CORRECT?

A) If the going rate of interest decreases from 10% to 0%, the difference between the present value of ORD and the present value of DUE would remain constant.

B) The present value of ORD must exceed the present value of DUE, but the future value of ORD may be less than the future value of DUE.

C) The present value of DUE exceeds the present value of ORD, while the future value of DUE is less than the future value of ORD.

D) The present value of ORD exceeds the present value of DUE, and the future value of ORD also exceeds the future value of DUE.

E) The present value of DUE exceeds the present value of ORD, and the future value of DUE also exceeds the future value of ORD.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A U.S.Treasury bond will pay a lump sum of $1,000 exactly 3 years from today.The nominal interest rate is 6%, semiannual compounding.Which of the following statements is CORRECT?

A) The PV of the $1,000 lump sum has a smaller present value than the PV of a 3-year, $333.33 ordinary annuity.

B) The periodic interest rate is greater than 3%.

C) The periodic rate is less than 3%.

D) The present value would be greater if the lump sum were discounted back for more periods.

E) The present value of the $1,000 would be larger if interest were compounded monthly rather than semiannually.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank offers a savings account that pays 3.5% interest, compounded annually.If you invest $1,000 in the account, then how much will it be worth at the end of 25 years?

A) $2,245.08

B) $2,363.24

C) $2,481.41

D) $2,605.48

E) $2,735.75

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If some cash flows occur at the beginning of the periods while others occur at the ends, then we have what the textbook defines as a variable annuity.

B) The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods.

C) If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity.

D) The cash flows for an annuity due must all occur at the ends of the periods.

E) The cash flows for an annuity must all be equal, and they must occur at regular intervals, such as once a year or once a month.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of the following cash flow stream at a rate of 12.0%?

A) $9,699

B) $10,210

C) $10,747

D) $11,284

E) $11,849

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 163

Related Exams