Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beginning inventory plus the cost of goods purchased equals

A) cost of goods sold.

B) cost of goods available for sale.

C) net purchases.

D) total goods purchased.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

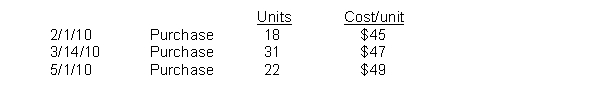

Lee Industries had the following inventory transactions occur during 2010:  The company sold 51 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using LIFO? (rounded to whole dollars)

The company sold 51 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using LIFO? (rounded to whole dollars)

A) $2,441

B) $2,365

C) $848

D) $772

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold is computed from the following equation:

A) beginning inventory - cost of goods purchased + ending inventory.

B) sales - cost of goods purchased + beginning inventory - ending inventory.

C) sales + gross profit - ending inventory + beginning inventory.

D) beginning inventory + cost of goods purchased - ending inventory

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

It is generally recognized that a major objective of accounting for inventory is the proper determination of ______________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory items on an assembly line in various stages of production are classified as

A) Finished goods.

B) Work in process.

C) Raw materials.

D) Merchandise inventory.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

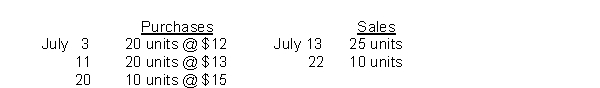

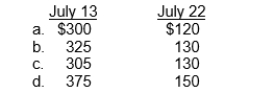

During July, the following purchases and sales were made by James Company. There was no beginning inventory. James Company uses a perpetual inventory system.  Under the FIFO method, the cost of goods sold for each sale is:

Under the FIFO method, the cost of goods sold for each sale is:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory is reported in the financial statements at

A) cost.

B) market.

C) the higher-of-cost-or-market.

D) the lower-of-cost-or-market.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goods in transit should be included in the inventory of the buyer when the

A) public carrier accepts the goods from the seller.

B) goods reach the buyer.

C) terms of sale are FOB destination.

D) terms of sale are FOB shipping point.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The specific identification method of costing inventories is used when the

A) physical flow of units cannot be determined.

B) company sells large quantities of relatively low cost homogeneous items.

C) company sells large quantities of relatively low cost heterogeneous items.

D) company sells a limited quantity of high-unit cost items.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jenner Company had beginning inventory of $90,000, ending inventory of $110,000, cost of goods sold of 400,000, and sales of 660,000. Jenner's days in inventory is:

A) 55.3 days.

B) 91.3 days.

C) 101.4 days.

D) 60.8 days.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

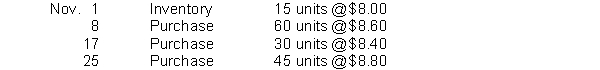

Shandy Shutters has the following inventory information.  A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand. Assume a periodic inventory system is used. Assuming that the specific identification method is used and that ending inventory consists of 15 units from each of the three purchases and 5 units from the November 1 inventory, cost of goods sold is

A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand. Assume a periodic inventory system is used. Assuming that the specific identification method is used and that ending inventory consists of 15 units from each of the three purchases and 5 units from the November 1 inventory, cost of goods sold is

A) $427.

B) $857.

C) $854.

D) $836.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

If beginning inventory is understated by $10,000, the effect of this error in the current period is

Correct Answer

verified

Correct Answer

verified

True/False

Management may choose any inventory costing method it desires as long as the cost flow assumption chosen is consistent with the physical movement of goods in the company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shandy Shutters has the following inventory information.  A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand. Assume a periodic inventory system is used. Ending inventory under LIFO is

A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand. Assume a periodic inventory system is used. Ending inventory under LIFO is

A) $438.

B) $421.

C) $846.

D) $863.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The consistent application of an inventory costing method is essential for

A) conservatism.

B) accuracy.

C) comparability.

D) efficiency.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sawyer Company uses the perpetual inventory system and the moving-average method to value inventories. On August 1, there were 10,000 units valued at $40,000 in the beginning inventory. On August 10, 20,000 units were purchased for $8 per unit. On August 15, 24,000 units were sold for $16 per unit. The amount charged to cost of goods sold on August 15 was

A) $40,000.

B) $160,000.

C) $192,000.

D) $144,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The more inventory a company has in stock, the greater the company's profit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accountants believe that the write down from cost to market should not be made in the period in which the price decline occurs.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

______________ is calculated as cost of goods sold divided by average inventory.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 204

Related Exams