A) comparability.

B) faithful representation.

C) consistency.

D) relevance.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following balance sheet and income statement data, what is the earnings per share?  Average common shares outstanding was 10,000.

Average common shares outstanding was 10,000.

A) $3.90

B) $6.00

C) $2.10

D) $0.48

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true?

A) Comparability means using the same accounting principles from year to year within a company.

B) Faithful representation is the quality of information that gives assurance that it is free of error.

C) Relevant accounting information must be capable of making a difference in the decision.

D) The primary objective of financial reporting is to provide financial information that is useful to investors and creditors for making decisions.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The historical cost principle requires that when assets are acquired, they be recorded at

A) market value.

B) the amount paid for them.

C) selling price.

D) list price.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reporting a net income of $95,000 will

A) increase retained earnings.

B) decrease retained earnings.

C) increase common stock.

D) decrease common stock.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Generally accepted accounting principles are rules and practices that are recognized as a general guide for financial reporting purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The debt to assets ratio is a

A) liquidity ratio.

B) profitability ratio.

C) solvency ratio.

D) None of the answer choices is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A liability is classified as a current liability if it is to be paid within the coming year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ratios that measure the income or operating success of a company for a given period of time are

A) liquidity ratios.

B) profitability ratios.

C) solvency ratios.

D) trending ratios.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow represents

A) cash provided by operations less adjustments for capital expenditures and dividends.

B) a measurement of a company's cash generating ability.

C) a measure of solvency.

D) All of these answer choices are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement about long-term investments is not true?

A) They will be held for more than one year.

B) They are not currently used in the operation of the business.

C) They include investments in stock of other companies and land held for future use.

D) They do not include long-term notes receivable.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current assets divided by current liabilities is known as the

A) working capital.

B) current ratio.

C) profit margin.

D) capital structure.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principle that indicates that assets should be reported at the price received to sell an asset is the

A) historical cost principle.

B) fair value principle.

C) full disclosure principle.

D) consistency principle.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

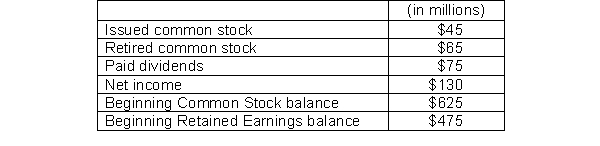

Dawson Corporation has the following information available for 2014:  Based on this information, what is Dawson's Retained Earnings balance at the end of the year?

Based on this information, what is Dawson's Retained Earnings balance at the end of the year?

A) $680

B) $530

C) $420

D) $605

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The primary accounting standard-setting body in the United States is the Securities and Exchange Commission.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an accounting assumption?

A) Integrity

B) Going concern

C) Periodicity

D) Economic entity

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It is assumed that the activities of Ford Motor company can be distinguished from those of General Motors because of the

A) going concern assumption.

B) economic entity assumption.

C) monetary unit assumption.

D) periodicity assumption.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most companies that follow IFRS present balance sheet (statement of financial position) information in this order.

A) current assets; investments; property; plant and equipment; intangible assets; current liabilities; long term liabilities; owners' equity.

B) intangible assets; property; plant and equipment; investments; current assets; current liabilities; owners' equity; long term liabilities.

C) current assets; noncurrent assets; current liabilities; noncurrent liabilities; equity.

D) noncurrent assets; current assets; equity; noncurrent liabilities; current liabilities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Consistency in accounting means that a company uses the same generally accepted accounting principles from one accounting period to the next accounting period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Issuing new shares of common stock will

A) increase retained earnings.

B) decrease retained earnings.

C) increase common stock.

D) decrease common stock.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 238

Related Exams