B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the unit cost to buy something is less than the variable cost to make it, the decision to make or buy is based solely on the fixed costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

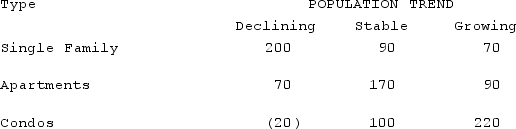

The construction manager for Acme Construction, Inc., must decide whether to build single-family homes, apartments, or condominiums. He estimates annual profits (in $000) will vary with the population trend as follows:

If he uses the maximin criterion, which kind of dwellings will he decide to build?

If he uses the maximin criterion, which kind of dwellings will he decide to build?

A) single family

B) apartments

C) condominiums

D) either single family or apartments

E) either apartments or condos

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Unbalanced systems are evidenced by:

A) top-heavy operations.

B) labor unrest.

C) bottleneck operations.

D) increasing capacities.

E) assembly lines.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The maximin approach involves choosing the alternative with the highest payoff.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner of Firewood To Go is considering buying a hydraulic wood splitter which sells for $50,000. He figures it will cost an additional $100 per cord to purchase and split wood with this machine, while he can sell each cord of split wood for $125. How many cords of wood would he have to split with this machine to make a profit of $30,000?

A) 3,200

B) 1,500

C) 2,000

D) 1,000

E) 500

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be a potential upside in a decision to outsource?

A) increased total production capacity

B) potential to lower fixed costs

C) supplier may have greater expertise to do the outsourced work

D) disclosure of proprietary information to supplier

E) supplier cost may be lower

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One local hospital has just enough space and funds currently available to start either a cancer or heart research lab. If administration decides on the cancer lab, there is a 20 percent chance of getting $100,000 in outside funding from the American Cancer Society next year, and an 80 percent chance of getting nothing. If the cancer research lab is funded the first year, no additional outside funding will be available the second year. However, if it is not funded the first year, then management estimates the chances are 50 percent it will get $100,000 the following year, and 50 percent that it will get nothing again. If, however, the hospital's management decides to go with the heart lab, then there is a 50 percent chance of getting $50,000 in outside funding from the American Heart Association the first year and a 50 percent chance of getting nothing. If the heart lab is funded the first year, management estimates a 40 percent chance of getting another $50,000 and a 60 percent chance of getting nothing additional the second year. If it is not funded the first year, then management estimates a 60 percent chance for getting $50,000 and a 40 percent chance for getting nothing in the following year. For both the cancer and heart research labs, no further possible funding is anticipated beyond the first two years. What is the expected value for the decision alternative to select the heart lab?

A) $100,000

B) $60,000

C) $50,000

D) $40,000

E) $20,000

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

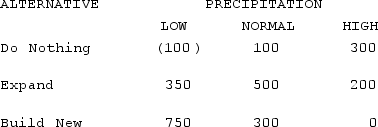

The operations manager for a well-drilling company must recommend whether to build a new facility, expand his existing one, or do nothing. He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:

If he uses the Laplace criterion, which alternative will he decide to select?

If he uses the Laplace criterion, which alternative will he decide to select?

A) do nothing

B) expand

C) build new

D) either do nothing or expand

E) either expand or build new

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The break-even quantity can be determined by dividing the fixed costs by the difference between the revenue per unit and the variable cost per unit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One local hospital has just enough space and funds currently available to start either a cancer or heart research lab. If administration decides on the cancer lab, there is a 20 percent chance of getting $100,000 in outside funding from the American Cancer Society next year, and an 80 percent chance of getting nothing. If the cancer research lab is funded the first year, no additional outside funding will be available the second year. However, if it is not funded the first year, then management estimates the chances are 50 percent it will get $100,000 the following year, and 50 percent that it will get nothing again. If, however, the hospital's management decides to go with the heart lab, then there is a 50 percent chance of getting $50,000 in outside funding from the American Heart Association the first year and a 50 percent chance of getting nothing. If the heart lab is funded the first year, management estimates a 40 percent chance of getting another $50,000 and a 60 percent chance of getting nothing additional the second year. If it is not funded the first year, then management estimates a 60 percent chance for getting $50,000 and a 40 percent chance for getting nothing in the following year. For both the cancer and heart research labs, no further possible funding is anticipated beyond the first two years. What is the expected value for the optimum decision alternative?

A) $100,000

B) $60,000

C) $50,000

D) $40,000

E) $20,000

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner of Firewood To Go is considering buying a hydraulic wood splitter which sells for $50,000. He figures it will cost an additional $100 per cord to purchase and split wood with this machine, while he can sell each cord of split wood for $125. How many cords of wood would he have to split with this machine to break even?

A) 5,000

B) 3,000

C) 2,000

D) 1,000

E) 0

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Stating capacity in dollar amounts generally results in a consistent measure of capacity regardless of the actual units of measure.

B) False

Correct Answer

verified

Correct Answer

verified

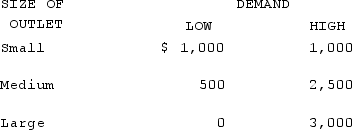

Multiple Choice

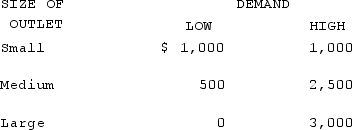

The owner of Tastee Cookies needs to decide whether to lease a small, medium, or large new retail outlet. She estimates that monthly profits will vary with demand for her cookies as follows:

If she uses the maximin criterion, what size outlet will she decide to lease?

If she uses the maximin criterion, what size outlet will she decide to lease?

A) small

B) medium

C) large

D) either small or medium

E) either medium or large

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production. (Due to budgeting constraints, only one new picture can be undertaken at this time.) She feels that script 1 has a 70 percent chance of earning about $10,000,000 over the long run, but a 30 percent chance of losing $2,000,000. If this movie is successful, then a sequel could also be produced, with an 80 percent chance of earning $5,000,000, but a 20 percent chance of losing $1,000,000. On the other hand, she feels that script 2 has a 60 percent chance of earning $12,000,000, but a 40 percent chance of losing $3,000,000. If successful, its sequel would have a 50 percent chance of earning $8,000,000, but a 50 percent chance of losing $4,000,000. Of course, in either case, if the original movie were a flop, then no sequel would be produced. What would be the total payoff if script 1 were a success, but its sequel were not?

A) $15,000,000

B) $10,000,000

C) $9,000,000

D) $5,000,000

E) $−1,000,000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would tend to reduce effective capacity?

A) suppliers that provide more reliable delivery performance

B) reduced changeover times

C) employees that are fully trained

D) improved production quality

E) greater variety in the product line

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

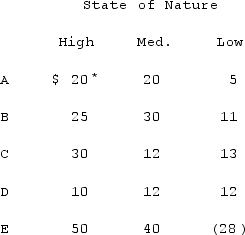

Consider the following decision scenario:

*PV for profits ($000)

The maximax strategy would be:

*PV for profits ($000)

The maximax strategy would be:

A) A.

B) B.

C) C.

D) D.

E) E.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production. (Due to budgeting constraints, only one new picture can be undertaken at this time.) She feels that script 1 has a 70 percent chance of earning about $10,000,000 over the long run, but a 30 percent chance of losing $2,000,000. If this movie is successful, then a sequel could also be produced, with an 80 percent chance of earning $5,000,000, but a 20 percent chance of losing $1,000,000. On the other hand, she feels that script 2 has a 60 percent chance of earning $12,000,000, but a 40 percent chance of losing $3,000,000. If successful, its sequel would have a 50 percent chance of earning $8,000,000, but a 50 percent chance of losing $4,000,000. Of course, in either case, if the original movie were a flop, then no sequel would be produced. What is the expected value of selecting script 2?

A) $15,000,000

B) $9,060,000

C) $8,400,000

D) $7,200,000

E) $6,000,000

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Virginia county is considering whether to pay $50,000 per year to lease a prisoner transfer facility in a prime location near Washington, D.C. They estimate it will cost $50 per prisoner to process the paperwork at this new location. The county is paid a $75 commission for each new prisoner they process. If their holding area at this new location has design and effective capacities of 10,000 and 7,500 prisoners processed annually, respectively, and they plan to be 80 percent efficient in their use of this space, how many prisoners does the county plan to process per year?

A) 5,000

B) 8,000

C) 2,000

D) 4,000

E) 6,000

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner of Tastee Cookies needs to decide whether to lease a small, medium, or large new retail outlet. She estimates that monthly profits will vary with demand for her cookies as follows:

If she feels there is a 30 percent chance that demand will be high, what is her expected payoff under certainty?

If she feels there is a 30 percent chance that demand will be high, what is her expected payoff under certainty?

A) $1,600

B) $1,100

C) $1,000

D) $900

E) $500

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 210

Related Exams