A) completing Forms W-2.

B) completing the journal entry to record the payroll.

C) determining when the accumulated wages of an employee reach cutoff levels.

D) preparing reports required by state unemployment compensation laws.

E) preparing the payroll register.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

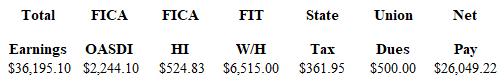

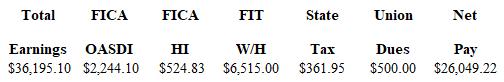

Exhibit 6-1  Refer to Exhibit 6-1 . Journalize the entry to record the payroll.

Refer to Exhibit 6-1 . Journalize the entry to record the payroll.

Correct Answer

verified

Correct Answer

verified

True/False

Every state allows employers to make e-payment options as a condition of employment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items would require an adjusting entry at the end of each accounting period?

A) Garnishment for child support payments

B) Withholdings for a 401(k) plan

C) Vacation pay earned by employees

D) Union dues withheld

E) None of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the case of a federal tax levy, the employee will notify the employer of the amount the employee wants taken out of his or her paycheck.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Deductions from gross pay in the payroll register are reflected on the credit side of the journal entry to record the payroll.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry made at the end of the accounting period to record wages incurred but unpaid is:

A) Wages Expense Wages Payable

B) Wages Expense FICA Taxes Payable-OASDI

FICA Taxes Payable-HI

FIT Payable

Wages Payable

C) Wages Payable Cash

D) Wages Expense Cash

E) Wages Expense Payroll Taxes

Wages Payroll

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If employees must contribute to the state unemployment fund, this deduction should be shown in the payroll tax entry.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

FUTA Taxes Payable is an expense account in which are recorded the employer's federal unemployment taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Posting to the general ledger for payroll entries is done only at the end of each calendar year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carmen Gaetano worked 46 hours during this payweek. He is paid time-and-a-half for hours over 40 and his pay rate is $17.90/hour. What was his overtime premium pay for this workweek?

A) $107.40

B) $161.10

C) $50.70

D) $53.70

E) $26.85

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Essay

Exhibit 6-1

The totals from the first payroll of the year are shown below.  -Refer to Exhibit 6-1 . Journalize the adjustment for accrued wages for the following Monday, which is the end of the accounting period. The gross payroll for that day is $7,475.

-Refer to Exhibit 6-1 . Journalize the adjustment for accrued wages for the following Monday, which is the end of the accounting period. The gross payroll for that day is $7,475.

Correct Answer

verified

Wages Expense ...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

Since FUTA tax is paid only once a quarter, the FUTA tax expense is recorded only at the time of payment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For child support garnishments, tips are considered part of an employee's disposable earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The wage and salaries expense account is an operating expense account debited for total net pay each payroll period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The employer keeps track of each employee's accumulated wages in the employee's earnings record.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An employee's marital status and number of withholding allowances never appear on the payroll register.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts is an expense account in which an employer records the FICA, FUTA, and SUTA taxes?

A) Wages Expense

B) Payroll Taxes

C) SUTA Taxes Payable

D) Salaries Payable

E) None of the above

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

FICA Taxes Payable-HI is a liability account in which is recorded the liability of the employer for the HI tax on the employer as well as for the HI tax withheld from employees' wages.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In all computerized payroll systems, there is still the need to manually post from the printed payroll journal entry to the general ledger.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 75