B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If manufacturing overhead has been overallocated during the period, then

A) the jobs produced during the period have been undercosted.

B) the jobs produced during the period have been overcosted.

C) the jobs produced during the period have been costed correctly.

D) none of the above.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Job 450 requires $9,800 of direct materials, $6,400 of direct labor, 590 direct labor hours, and 400 machine hours. Manufacturing overhead is computed at $14 per direct labor hour used and $10 per machine hour used. The total cost of Job 450 is

A) $12,260.

B) $28,460.

C) $16,200.

D) $24,460.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturers follow four steps to implement a manufacturing overhead allocation system. What is the first step?

A) Select an allocation base and estimate the total amount that will be used during the year.

B) Allocate some manufacturing overhead to each individual job.

C) Calculate a predetermined manufacturing overhead rate.

D) Estimate total manufacturing overhead costs for the coming year.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A food and beverage company like Coca-Cola would most likely use job costing.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

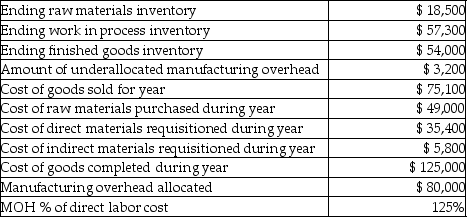

Stars and Stripes Corporation uses job costing. The following is selected financial data from the company for the most recent year.

Compute:

a)Beginning raw materials inventory

b)Beginning work in process inventory

c)Beginning finished goods inventory

d)Actual manufacturing overhead costs incurred during the year

Compute:

a)Beginning raw materials inventory

b)Beginning work in process inventory

c)Beginning finished goods inventory

d)Actual manufacturing overhead costs incurred during the year

Correct Answer

verified

Correct Answer

verified

Multiple Choice

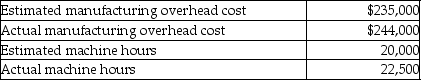

Ryan's Paints allocates overhead based on machine hours. Selected data for the most recent year follow.  The estimates were made as of the beginning of the year, while the actual results were for the entire year.

The amount of manufacturing overhead allocated for the year based on machine hours would have been

The estimates were made as of the beginning of the year, while the actual results were for the entire year.

The amount of manufacturing overhead allocated for the year based on machine hours would have been

A) $239,500.

B) $264,375.

C) $235,000.

D) $244,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Manufacturing overhead may include depreciation on the factory plant and equipment, utilities to run the plant, property taxes and insurance on the plant, and salaries of plant janitors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to issue $600 of direct materials and $40 of indirect materials involves a debit to

A) manufacturing overhead for $640.

B) work in process inventory for $640.

C) work in process inventory for $600 and a credit to manufacturing overhead for $40.

D) work in process inventory for $600 and a debit to manufacturing overhead for $40.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

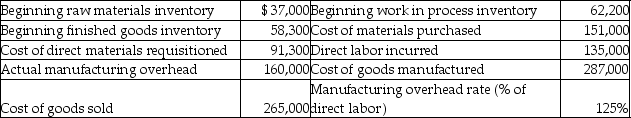

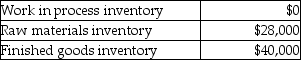

Here are selected data for Sunny Sky Corporation:  What is the ending work in process inventory balance?

What is the ending work in process inventory balance?

A) $161,500

B) $170,250

C) $211,200

D) $229,950

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Here are selected data for Tyler Corporation:  What is the balance in work in process inventory at the end of the year?

What is the balance in work in process inventory at the end of the year?

A) $30,300

B) $27,700

C) $49,200

D) $23,800

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Manufacturers follow four steps to implement a manufacturing overhead allocation system. The last step is to allocate some manufacturing overhead to each individual job.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

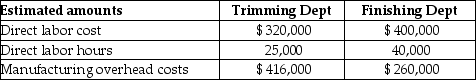

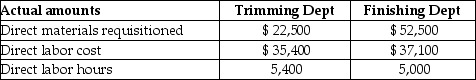

Solid Oak Bureau uses job costing. Solid Oak Bureau Company has two departments, Trimming and Finishing. Manufacturing overhead is allocated based on direct labor cost in the Trimming Department and direct labor hours in the Finishing Department. The following additional information is available:  Actual data for completed Job No. 650 is as follows:

Actual data for completed Job No. 650 is as follows:

If Job No. 650 consists of 500 units of product, the average unit cost of this job is closest to

If Job No. 650 consists of 500 units of product, the average unit cost of this job is closest to

A) $452.04.

B) $414.46.

C) $157.04.

D) $295.00.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry needed to record the receipt of a factory utility bill would include a

A) debit to manufacturing overhead.

B) credit to manufacturing overhead.

C) debit to accounts payable.

D) debit to utilities payable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The gross profit on the sale of a job is the difference between the sales price and the total cost reported on the job cost record.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following account balances at the beginning of January were selected from the general ledger of Ocean City Manufacturing Company:  Additional data:1) Actual manufacturing overhead for January amounted to $62,000.

2) Total direct labor cost for January was $63,000.

3) The predetermined manufacturing overhead rate is based on direct labor cost. The budget for the year called for $250,000 of direct labor cost and $350,000 of manufacturing overhead costs.

4) The only job unfinished on January 31 was Job No. 151, for which total direct labor charges were $5,200 (800 direct labor hours) and total direct material charges were $14,000.

5) Cost of direct materials placed in production during January totaled $123,000. There were no indirect material requisitions during January.

6) January 31 balance in raw materials inventory was $35,000.

"7) Finished goods inventory balance on January 31 was $34,500.

What is the predetermined manufacturing overhead rate?"

Additional data:1) Actual manufacturing overhead for January amounted to $62,000.

2) Total direct labor cost for January was $63,000.

3) The predetermined manufacturing overhead rate is based on direct labor cost. The budget for the year called for $250,000 of direct labor cost and $350,000 of manufacturing overhead costs.

4) The only job unfinished on January 31 was Job No. 151, for which total direct labor charges were $5,200 (800 direct labor hours) and total direct material charges were $14,000.

5) Cost of direct materials placed in production during January totaled $123,000. There were no indirect material requisitions during January.

6) January 31 balance in raw materials inventory was $35,000.

"7) Finished goods inventory balance on January 31 was $34,500.

What is the predetermined manufacturing overhead rate?"

A) 71%

B) 140%

C) 70%

D) 99%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

At Plastastic, Inc., the beginning balance of the work in process inventory account in April of the most recent year was $19,000. Direct materials used during April totaled $130,000. Total manufacturing labor incurred in April was $180,000, 75% of this amount represented direct labor. The predetermined manufacturing overhead rate is 130% of direct labor cost. Actual manufacturing overhead costs for April amounted to $160,000. In April, two jobs were completed with total costs of $110,000 and $95,000, respectively. In April, the two jobs were sold on account for $187,000 and $124,000, respectively. a)Compute the balance in work in process inventory on April 30. b)Record the journal entry for direct materials used in April. c)Record the journal entry to record labor costs for April. d)Record the journal entry for allocated manufacturing overhead for April. e)Record the entry to move the completed jobs into finished goods inventory in April. f)Record the entry to sell the two completed jobs on account in April.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead is allocated on the basis of

A) machine hours.

B) direct labor hours.

C) direct labor costs.

D) any of the listed choices.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A ________ is a document which is prepared by manufacturing personnel to request materials for the production process.

A) cost ticket

B) job cost record

C) materials requisition

D) manufacturing ticket

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Companies use job costing when their products or services vary in terms of materials needed, time required to complete the product, and/or the complexity of the production process.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 334

Related Exams