A) $6,400

B) $6,700

C) $6,900

D) $7,000

E) $7,200

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following defines the relationship between the value of an option and the option's time to expiration?

A) theta.

B) vega.

C) rho.

D) delta.

E) gamma.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock is currently selling for $36 a share. The risk-free rate is 3.8 percent and the standard deviation is 27 percent. What is the value of d1 of a 9-month call option with a strike price of $40?

A) -0.21872

B) -0.21179

C) -0.21047

D) -0.20950

E) -0.20356

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grocery Express stock is selling for $22 a share. A 3-month, $20 call on this stock is priced at $2.65. Risk-free assets are currently returning 0.2 percent per month. What is the price of a 3-month put on Grocery Express stock with a strike price of $20?

A) $0.37

B) $0.53

C) $0.67

D) $1.10

E) $1.18

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the correct formula for approximating the change in an option's value given a small change in the value of the underlying stock?

A) Change in option value Change in stock value/Delta

B) Change in option value Change in stock value/(1 - Delta)

C) Change in option value Change in stock value/(1 + Delta)

D) Change in option value Change in stock value * (1 - Delta)

E) Change in option value Change in stock value * Delta

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

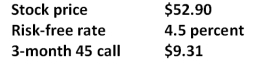

What is the value of a 3-month put with a strike price of $45 given the Black-Scholes option pricing model and the following information?

A) $0.57

B) $0.63

C) $0.91

D) $1.36

E) $1.54

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

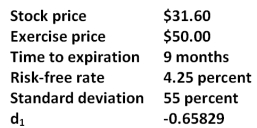

Given the following information, what is the value of d2 as it is used in the Black-Scholes option pricing model?

A) -1.1346

B) -0.8657

C) -0.8241

D) -0.7427

E) -0.7238

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A.K. Scott's stock is selling for $38 a share. A 3-month call on this stock with a strike price of $35 is priced at $3.40. Risk-free assets are currently returning 0.18 percent per month. What is the price of a 3-month put on this stock with a strike price of $35?

A) $0.21

B) $0.49

C) $4.99

D) $5.85

E) $6.20

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following can be used to replicate a protective put strategy?

A) riskless investment and stock purchase

B) stock purchase and call option

C) call option and riskless investment

D) riskless investment

E) call option, stock purchase, and riskless investment

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given the (1) exercise price E, (2) time to maturity T, and (3) European put-call parity, the present value of E plus the value of the call option is equal to the:

A) current market value of the stock.

B) present value of the stock minus the value of the put.

C) value of the put minus the market value of the stock.

D) value of a risk-free asset.

E) stock value plus the put value.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the price of the underlying stock decreases. How will the values of the options respond to this change? I. call value decreases II. call value increases III. put value decreases IV. put value increases

A) I and III only

B) I and IV only

C) II and III only

D) II and IV only

E) I only

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A put option that expires in eight months with an exercise price of $57 sells for $3.85. The stock is currently priced at $59, and the risk-free rate is 3.1 percent per year, compounded continuously. What is the price of a call option with the same exercise price and expiration date?

A) $6.67

B) $7.02

C) $7.34

D) $7.71

E) $7.80

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will provide you with the same value that you would have if you just purchased BAT stock?

A) sell a put option on BAT stock and invest at the risk-free rate of return

B) buy both a call option and a put option on BAT stock and also lend out funds at the risk-free rate

C) sell a put and buy a call on BAT stock as well as invest at the risk-free rate of return

D) lend out funds at the risk-free rate of return and sell a put option on BAT stock

E) borrow funds at the risk-free rate of return and invest the proceeds in equivalent amounts of put and call options on BAT stock

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following acts like an insurance policy if the price of a stock you own suddenly decreases in value?

A) sale of a European call option

B) sale of an American put option

C) purchase of a protective put

D) purchase of a protective call

E) either the sale or purchase of a put

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To compute the value of a put using the Black-Scholes option pricing model, you:

A) first have to apply the put-call parity relationship.

B) first have to compute the value of the put as if it is a call.

C) compute the value of an equivalent call and then subtract that value from one.

D) compute the value of an equivalent call and then subtract that value from the market price of the stock.

E) compute the value of an equivalent call and then multiply that value by e-RT.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amy just purchased a right to buy 100 shares of LKL stock for $35 a share on June 20, 2009. Which one of the following did Amy purchase?

A) American delta

B) American call

C) American put

D) European put

E) European call

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Traci wants to have $16,000 six years from now and wants to deposit just one lump sum amount today. The annual percentage rate applicable to her investment is 6.8 percent. Which one of the following methods of compounding interest will allow her to deposit the least amount possible today?

A) annual

B) daily

C) quarterly

D) monthly

E) continuous

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A purely financial merger:

A) increases the risk that the merged firm will default on its debt obligations.

B) has no effect on the risk level of the firm's debt.

C) reduces the value of the option to go bankrupt.

D) has no effect on the equity value of a firm.

E) reduces the risk level of the firm and increases the value of the firm's equity.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the standard deviation of the returns on ABC stock increases. The effect of this change on the value of the call options on ABC stock is measured by which one of the following?

A) theta.

B) vega.

C) rho.

D) delta.

E) gamma.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Black-Scholes option pricing model can be used for:

A) American options but not European options.

B) European options but not American options.

C) call options but not put options.

D) put options but not call options.

E) both zero coupon bonds and coupon bonds.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 86

Related Exams