A) 2.04%

B) 12.00 %

C) 12.24%

D) 12.89%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of treasury bills that pay 5% and a risky portfolio, P, constructed with 2 risky securities X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 14% and Y has an expected rate of return of 10%. -The dollar values of your positions in X,Y,and treasury bills would be _________,__________ and __________ respectively if you decide to hold a complete portfolio that has an expected return of 8%.

A) $162, $595, $243

B) $243, $162, $595

C) $595, $162, $243

D) $595, $243, $162

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following two investment alternatives.First,a risky portfolio that pays 20% rate of return with a probability of 60% or 5% with a probability of 40%.Second,a treasury bill that pays 6%.If you invest $50,000 in the risky portfolio,your expected profit would be _________.

A) $3,000

B) $7,000

C) $7,500

D) $10,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following two investment alternatives.First,a risky portfolio that pays 15% rate of return with a probability of 40% or 5% with a probability of 60%.Second,a treasury bill that pays 6%.The risk premium on the risky investment is _________.

A) 1%

B) 3%

C) 6%

D) 9%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 16% and a standard deviation of 20% and a treasury bill with a rate of return of 6%. -The slope of the capital allocation line formed with the risky asset and the risk-free asset is _________.

A) 1.40

B) 0.80

C) 0.50

D) 0.40

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rank the following from highest average historical return to lowest average historical return from 1926-2008. I.Small stocks II.Long term bonds III.Large stocks IV.T-bills

A) I, II, III, IV

B) III, IV, II, I

C) I, III, II, IV

D) III, I, II, IV

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One method to forecast the risk premium is to use the _______.

A) coefficient of variation of analysts' earnings forecasts

B) variations in the risk free rate over time

C) average historical excess returns for the asset under consideration

D) average abnormal return on the index portfolio

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Historical returns have generally been __________ for stocks of small firms as/than for stocks of large firms.

A) the same

B) lower

C) higher

D) There is no evidence of a systematic relationship between returns on small firm stocks and returns on small firm stocks

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have calculated the historical dollar weighted return,annual geometric average return and annual arithmetic average return.You always reinvest your dividends and interest earned on the portfolio.Which method provides the best measure of the actual average historical performance of the investments you have chosen?

A) Dollar weighted return

B) Geometric average return

C) Arithmetic average return

D) Index return

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of treasury bills that pay 5% and a risky portfolio, P, constructed with 2 risky securities X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 14% and Y has an expected rate of return of 10%. -To form a complete portfolio with an expected rate of return of 11%,you should invest __________ of your complete portfolio in treasury bills.

A) 19%

B) 25%

C) 36%

D) 50%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Manhawkin Fund has an expected return of 16% and a standard deviation of 20%.The risk free rate is 4%.What is the reward-to-volatility ratio for the Manhawkin Fund?

A) 0.8

B) 0.6

C) 9.0

D) 1.0

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

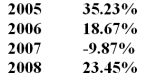

You have the following rates of return for a risky portfolio for several recent years:  -The annualized average return on this investment is

-The annualized average return on this investment is

A) 16.15%

B) 16.87%

C) 21.32%

D) 15.60%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From 1926 to 2008 the world stock portfolio offered _____ return and _____ volatility than the portfolio of large U.S.stocks.

A) lower; higher

B) lower; lower

C) higher; lower

D) higher; higher

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment earns 10% the first year,15% the second year and loses 12% the third year.Your total compound return over the three years was ______.

A) 41.68%

B) 11.32%

C) 3.64%

D) 13.00%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have an EAR of 9%.The equivalent APR with continuous compounding is _____.

A) 8.47%

B) 8.62%

C) 8.88%

D) 9.42%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would be considered a risk-free asset in real terms as opposed to nominal?

A) Money market fund

B) U.S. T-bill

C) Short term corporate bonds

D) U.S. T-bill whose return was indexed to inflation

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 16% and a standard deviation of 20% and a treasury bill with a rate of return of 6%. -The return on the risky portfolio is 15%.The risk-free rate as well as the investor's borrowing rate is 10%.The standard deviation of return on the risky portfolio is 20%.If the standard deviation on the complete portfolio is 25%,the expected return on the complete portfolio is _________.

A) 6.00%

B) 8.75 %

C) 10.00%

D) 16.25%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your timing was good last year.You invested more in your portfolio right before prices went up and you sold right before prices went down.In calculating historical performance measures which one of the following will be the largest?

A) Dollar weighted return

B) Geometric average return

C) Arithmetic average return

D) Mean holding period return

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Annual percentage rates can be converted to effective annual rates by means of the following formula:

A) (1 + (APR/n) ) n - 1

B) (APR) (n)

C) (APR/n)

D) (periodic rate) (n)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The formula  is used to calculate the _____________.

is used to calculate the _____________.

A) Sharpe measure

B) Treynor measure

C) Coefficient of variation

D) Real rate of return

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 83

Related Exams