A) $249,000.

B) $7,000.

C) $(103,000) .

D) $(6,000) .

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Maine Company reported cost of goods sold of $110,000.Inventories increased by $30,000 during the year, and accounts payable decreased by $15,000.The company uses the direct method to determine the net cash flows from operating activities on the statement of cash flows.The cost of goods sold adjusted to a cash basis would be

A) $140,000.

B) $65,000.

C) $155,000.

D) $125,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year, Uranium Company's cash account increased by $20,000.Net cash flow from investing activities were ($35,000) .Net cash flow from financing activities were $3,000.On the statement of cash flows, net cash flow from operating activities were:

A) $38,000.

B) ($15,000) .

C) $52,000.

D) ($32,000) .

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the order of presentation of activities on the statement of cash flows?

A) Operating, investing, financing

B) Marketing, financing, manufacturing

C) Financing, outsourcing, investing

D) Manufacturing, investing, operating

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The format that should be followed in preparing the statement of cash flows is known as the ______________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

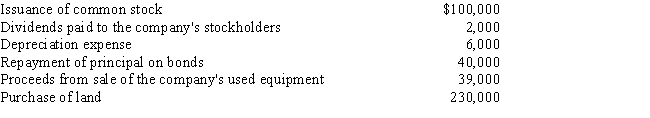

The following transactions were made by Ruby Inc.last year: Based solely on the above information, net cash flow from financing activities for the year on the statement of cash flows would be:

Based solely on the above information, net cash flow from financing activities for the year on the statement of cash flows would be:

A) $58,000.

B) ($150,000) .

C) ($67,000) .

D) $29,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the indirect method, patent amortization expense for the period

A) is deducted from net income.

B) has no impact on cash flows.

C) causes cash to decrease.

D) is added to net income.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

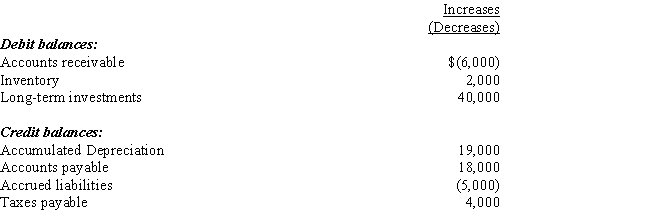

Long Company's net income last year was $43,000 and cash dividends declared and paid to the company stockholders was $28,000.Changes in selected balance sheet accounts for the year appear below:  Based solely on this information, the net cash flows from operating activities under the indirect method on the statement of cash flows would be

Based solely on this information, the net cash flows from operating activities under the indirect method on the statement of cash flows would be

A) $25,000.

B) $62,000.

C) $83,000.

D) $3,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of the statement of cash flows is to

A) provide information about the investing and financing activities during the period.

B) prove that revenues exceed expenses if there is a net income.

C) provide information about the sources and uses of cash during a period.

D) facilitate banking relationships.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

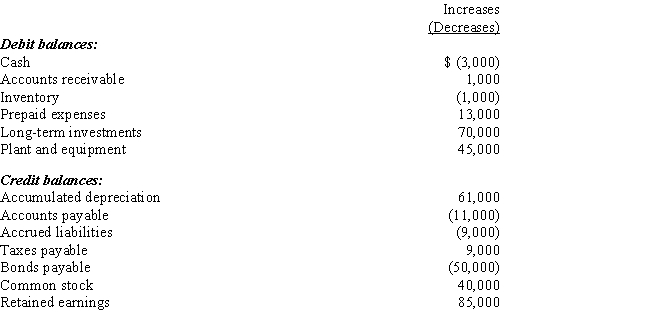

Chandler Company's net income last year was $98,000 and cash dividends declared and paid to the company stockholders was $13,000.Changes in selected balance sheet accounts for the year appear below:

- The net cash flows from operating activities to be reported in a statement of cash flows is

- The net cash flows from operating activities to be reported in a statement of cash flows is

A) $135,000.

B) $98,000.

C) $159,000.

D) $74,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Activities that increase cash are sources of cash and are referred to as ___________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following major cash flow activities to classify the activities listed below: -Issued long-term debt

A) Operating Activity, Source of Cash

B) Operating Activity, Use of Cash

C) Investing Activity, Source of Cash

D) Investing Activity, Use of Cash

E) Financing Activity, Source of Cash

F) Financing Activity, Use of Cash

G) Non-cash Investing & Financing Activity

I) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Land costing $78,000 was sold for $93,000 cash.The gain on the sale was reported on the income statement as other income.On the statement of cash flows, what amount should be reported as an investing activity from the sale of land?

A) $78,000

B) $108,000

C) $93,000

D) $15,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 153 of 153

Related Exams