B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the cyclically-adjusted budget has a zero deficit but the actual budget has a $100 billion deficit, then that means that the government is pursuing an expansionary fiscal policy.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The actual and cyclically-adjusted budgets will be equal when the economy is at full employment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that if there was no crowding-out, an increase in government spending would increase GDP by $100 billion. If there had been partial crowding-out, however, then GDP would have:

A) Increased by more than $100 billion

B) Increased by less than $100 billion

C) Increased by $100 billion

D) Not increased

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Built-in stability is exemplified by the fact that with a progressive tax system, net tax revenues decrease when GDP decreases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The American Recovery and Reinvestment Act of 2009 included mostly:

A) Increases in taxes and in government spending

B) Decreases in taxes and in government spending

C) Increases in government spending and decreases in taxes

D) Decreases in government spending and increases in taxes

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last year when there was a surplus in the actual U.S. Federal budget was in:

A) 2001

B) 2002

C) 2003

D) 2004

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most of the U.S. public debt is owed to the nation's citizens and domestic institutions. This is one reason that the public debt:

A) Crowds out private investment

B) Does not impose a large burden on future generations

C) Has a pro-cyclical economic effect on the economy

D) Can result in the bankruptcy of the Federal government

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The United States is experiencing a recession and Congress decides to adopt an expansionary fiscal policy to stimulate the economy. In this case, the crowding-out effect suggests that investment spending would:

A) Increase, thus partially offsetting the fiscal policy

B) Increase, thus partially reinforcing the fiscal policy

C) Decrease, thus partially offsetting the fiscal policy

D) Decrease, thus partially reinforcing the fiscal policy

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following fiscal policy changes would be the most contractionary?

A) A $40 billion increase in taxes

B) A $10 billion increase in taxes and a $30 billion cut in government spending

C) A $20 billion increase in taxes and a $20 billion cut in government spending

D) A $30 billion increase in taxes and a $10 billion cut in government spending

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the U.S. economy reached full employment in 2007, the cyclically-adjusted deficit that year was -1.3% of GDP. From this information, we know that the:

A) Actual budget deficit must have been very close to 0% of GDP

B) Government implemented a contractionary fiscal policy that year

C) Actual budget deficit must have been very close to -1.3% of GDP

D) Government implemented a more expansionary fiscal policy from 2006 to 2007

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Federal government takes budgetary action to stimulate the economy or rein in inflation, such policy is:

A) Active Monetary Policy

B) Automatic Fiscal Policy

C) Discretionary Fiscal Policy

D) Active Federal Policy

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

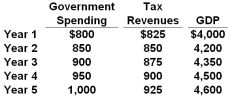

The following is budget information for a hypothetical economy. All data are in billions of dollars.  Refer to the above table. In which year is there a budget surplus?

Refer to the above table. In which year is there a budget surplus?

A) Year 1

B) Year 2

C) Year 4

D) Year 5

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Social Security Program is designed to pay:

A) Current retirees using funds from their past contributions

B) Current retirees using funds from current contributions

C) The lower income groups using funds collected from high-income groups

D) Older current workers using funds from younger current workers

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One important reason why the United States government is not likely to go bankrupt even with a large public debt is that it has:

A) The power to print money to finance the debt

B) A strong military to protect it from creditors

C) The capacity to pay off its outstanding debt with gold

D) The ability to decrease interest rates and increase investment spending

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A given reduction in government spending will dampen demand-pull inflation by a greater amount when the:

A) Economy's MPS is large

B) Economy's aggregate supply curve is flat

C) Economy's aggregate supply curve is steep

D) Unemployment rate is high

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cyclically-adjusted surplus as a percentage of GDP is 1 percent in Year 1. This surplus becomes a deficit of 2 percent of GDP in Year 2. It can be concluded from Year 1 to Year 2 that:

A) Fiscal policy turned more expansionary

B) Fiscal policy turned more contractionary

C) GDP increased

D) GDP decreased

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major concern with the Social Security trust fund is that:

A) Surpluses for Social Security are too large

B) The Federal government buys too many government securities

C) Costs for administering the fund are greater than the current revenue

D) The fund will exhausted in a couple of decades

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

More than half of the U.S. public debt is owed to Americans.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The set of fiscal policies that would be most contractionary would be a(n) :

A) Increase in government spending and taxes

B) Decrease in government spending and taxes

C) Increase in government spending and a decrease in taxes

D) Decrease in government spending and an increase in taxes

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 164

Related Exams