A) $179,400

B) $390,000

C) $421,200

D) $142,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

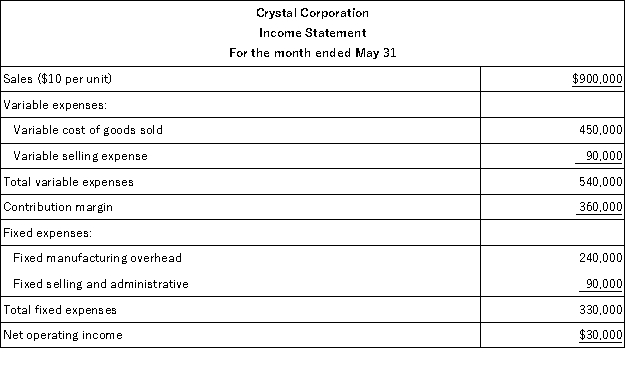

Crystal Corporation produces a single product.The company's variable costing income statement for the month of May appears below:  The company produced 80,000 units in May and the beginning inventory consisted of 25,000 units.Variable production costs per unit and total fixed costs have remained constant over the past several months. Under absorption costing,for May the company would report a:

The company produced 80,000 units in May and the beginning inventory consisted of 25,000 units.Variable production costs per unit and total fixed costs have remained constant over the past several months. Under absorption costing,for May the company would report a:

A) $30,000 loss

B) $0 profit

C) $30,000 profit

D) $60,000 profit

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

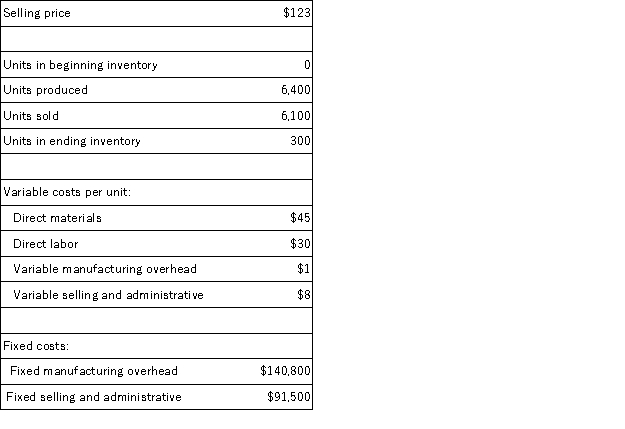

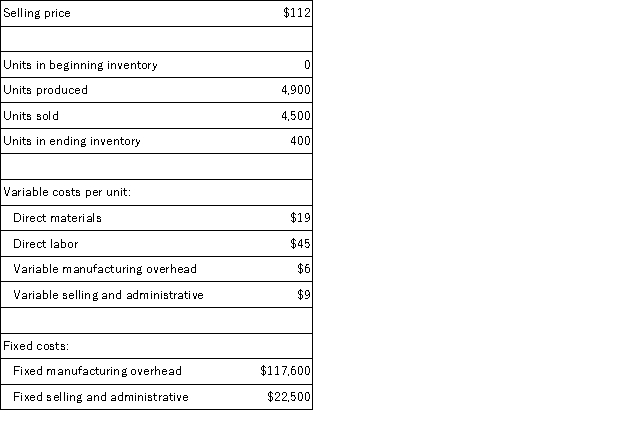

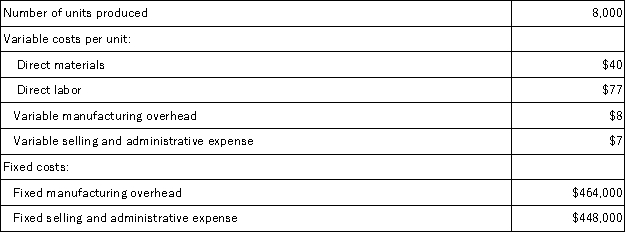

Hatfield Corporation,which has only one product,has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under variable costing?

What is the net operating income for the month under variable costing?

A) $6,600

B) $5,600

C) ($17,200)

D) $12,200

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

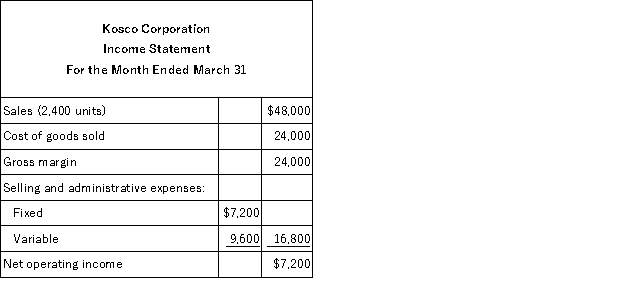

Kosco Corporation produces a single product.The company's absorption costing income statement for March follows:  During March,the company's variable production costs were $8 per unit and its fixed manufacturing overhead totaled $5,000. The break-even point in units for the month under variable costing would be:

During March,the company's variable production costs were $8 per unit and its fixed manufacturing overhead totaled $5,000. The break-even point in units for the month under variable costing would be:

A) 600 units

B) 900 units

C) 1,017 units

D) 1,525 units

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

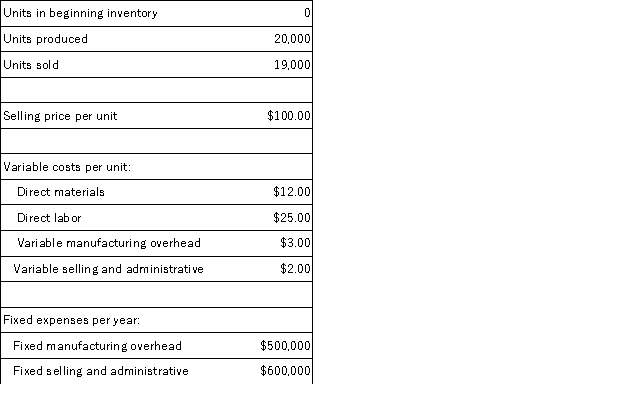

The following data pertain to last year's operations at Tredder Corporation,a company that produces a single product:  What was the absorption costing net operating income last year?

What was the absorption costing net operating income last year?

A) $12,000

B) $57,000

C) $2,000

D) $27,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Elliot Corporation,which has only one product,has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under absorption costing?

What is the net operating income for the month under absorption costing?

A) ($19,600)

B) $9,600

C) $8,400

D) $18,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

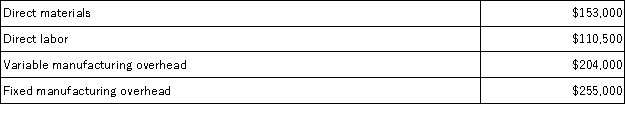

Harris Corporation produces a single product.Last year,Harris manufactured 17,000 units and sold 13,000 units.Production costs for the year were as follows:  Sales were $780,000 for the year,variable selling and administrative expenses were $88,400,and fixed selling and administrative expenses were $170,000.There was no beginning inventory.Assume that direct labor is a variable cost. Under variable costing,the company's net operating income for the year would be:

Sales were $780,000 for the year,variable selling and administrative expenses were $88,400,and fixed selling and administrative expenses were $170,000.There was no beginning inventory.Assume that direct labor is a variable cost. Under variable costing,the company's net operating income for the year would be:

A) $60,000 higher than under absorption costing

B) $108,000 higher than under absorption costing

C) $108,000 lower than under absorption costing

D) $60,000 lower than under absorption costing

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When sales are constant,but the number of units produced fluctuates,net operating income determined by the absorption costing method will:

A) tend to fluctuate in the same direction as fluctuations in the number of units produced.

B) tend to remain constant.

C) tend to fluctuate in the opposite direction as fluctuations in the number of units produced.

D) fluctuate without any relation to the number of units produced.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under variable costing,product costs consist of direct materials,direct labor,and variable manufacturing overhead.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principal difference between variable costing and absorption costing centers on:

A) whether variable manufacturing costs should be included in product costs.

B) whether fixed manufacturing costs should be included in product costs.

C) whether fixed manufacturing costs and fixed selling and administrative costs should be included in product costs.

D) whether selling and administrative costs should be included in product costs.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

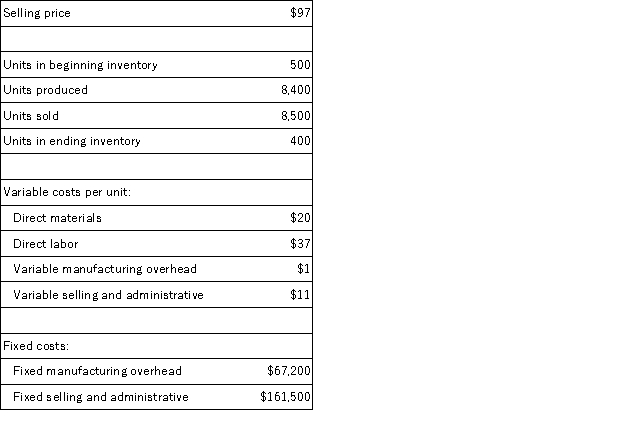

Khanam Corporation,which has only one product,has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month. What is the net operating income for the month under variable costing?

The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month. What is the net operating income for the month under variable costing?

A) $8,500

B) $9,300

C) $3,200

D) $15,100

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

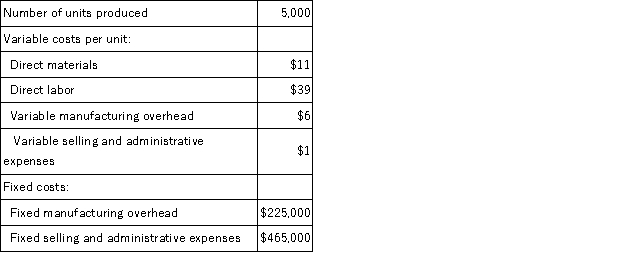

Ivancevic Inc. ,which produces a single product,has provided the following data for its most recent month of operation:  The company had no beginning or ending inventories.

Required:

Compute the unit product cost under variable costing.Show your work!

The company had no beginning or ending inventories.

Required:

Compute the unit product cost under variable costing.Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bartelt Inc. ,which produces a single product,has provided the following data for its most recent month of operations:  There were no beginning or ending inventories.The absorption costing unit product cost was:

There were no beginning or ending inventories.The absorption costing unit product cost was:

A) $125 per unit

B) $246 per unit

C) $117 per unit

D) $183 per unit

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

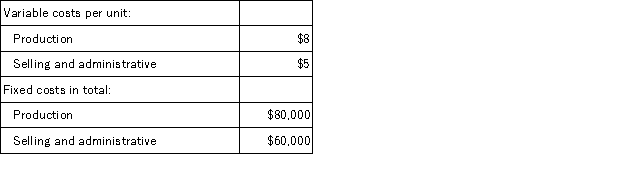

Johnston Corporation manufactures a single product that it sells for $30 per unit.The company has the following cost structure:  Last year there was no beginning inventory.During the year,20,000 units were produced and 17,000 units were sold. The company's net operating income for the year under variable costing is:

Last year there was no beginning inventory.During the year,20,000 units were produced and 17,000 units were sold. The company's net operating income for the year under variable costing is:

A) $110,000

B) $149,000

C) $161,000

D) $170,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

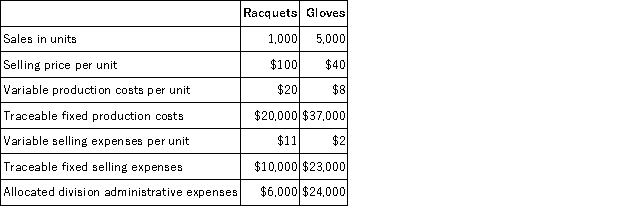

The Los Angeles Division of Awercamp Manufacturing produces and markets two product lines: Racquets and Gloves.The following data were gathered on activities last month:  Required:

Prepare a segmented income statement for last month.

Required:

Prepare a segmented income statement for last month.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

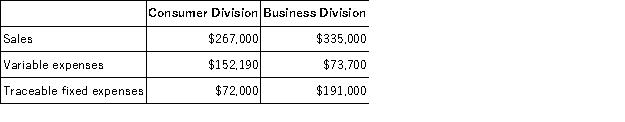

Phong Corporation has two divisions: Consumer Division and Business Division.The following data are for the most recent operating period:  The company's common fixed expenses total $102,340. The Business Division's break-even sales is closest to:

The company's common fixed expenses total $102,340. The Business Division's break-even sales is closest to:

A) $376,077

B) $317,885

C) $244,872

D) $584,762

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

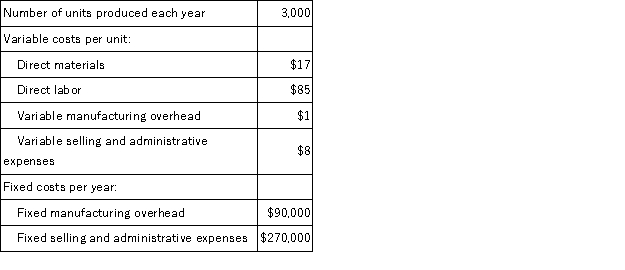

Hossack Corporation produces a single product and has the following cost structure:  The unit product cost under variable costing is:

The unit product cost under variable costing is:

A) $103 per unit

B) $133 per unit

C) $111 per unit

D) $110 per unit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Net operating income is affected by the number of units produced when absorption costing is used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sorto Corporation has two divisions: the East Division and the West Division.The corporation's net operating income is $93,200.The East Division's divisional segment margin is $223,200 and the West Division's divisional segment margin is $15,900.What is the amount of the common fixed expense not traceable to the individual divisions?

A) $316,400

B) $145,900

C) $109,100

D) $239,100

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cervetti Corporation has two major business segments-East and West.In July,the East business segment had sales revenues of $220,000,variable expenses of $125,000,and traceable fixed expenses of $29,000.During the same month,the West business segment had sales revenues of $890,000,variable expenses of $472,000,and traceable fixed expenses of $169,000.The common fixed expenses totaled $246,000 and were allocated as follows: $123,000 to the East business segment and $123,000 to the West business segment. A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

A) $315,000

B) $69,000

C) -$177,000

D) $513,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 223

Related Exams