A) consumer decisions are distorted and the ability of markets to efficiently allocate factors of production is impaired.

B) consumer decisions are distorted, but markets are still able to efficiently allocate factors of production.

C) consumer decisions are not distorted, but the ability of markets to efficiently allocate factors of production is impaired.

D) consumer decisions are not distorted and markets are still able to efficiently allocate factors of production.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of menu costs?

A) deciding on new prices

B) printing new price lists

C) advertising new prices

D) All of the above are examples of menu costs.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Hyperinflations are associated with governments printing money to finance expenditures.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The inflation tax refers to

A) the revenue a government creates by printing money.

B) higher inflation which requires more frequent price changes.

C) the idea that, other things the same, an increase in the tax rate raises the inflation rate.

D) taxes being indexed for inflation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You put money into an account and earn an after-tax real interest rate of 2.5 percent. If the nominal interest rate on the account is 8 percent and the inflation rate is 2 percent, then what is the tax rate?

A) 28.00 percent

B) 36.25 percent

C) 43.75 percent

D) 67.50 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If real output in an economy is 1,000 goods per year, the money supply is $300, and each dollar is spent an average of 3 times per year, then according to the quantity equation, the average price level is

A) $0.90.

B) $1.00.

C) $1.11.

D) $1.33.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The irrelevance of monetary changes for real variables is called monetary neutrality. Most economists accept monetary neutrality as a good description of the economy in the long run, but not the short run.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When money is neutral, which of the following increases when the money supply growth rate increases?

A) real output growth

B) real interest rates

C) nominal interest rates

D) the money supply divided by the price level

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When inflation rises, people

A) make less frequent trips to the bank and firms make less frequent price changes.

B) make less frequent trips to the bank while firms make more frequent price changes.

C) make more frequent trips to the bank while firms make less frequent price changes.

D) make more frequent trips to the bank and firms make more frequent price changes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

According to the Fisher effect, if inflation rises then the nominal interest rate rises.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Steve purchases some land for $30,000. He maintains it, but makes no improvements to it. One year later he sells it for $32,000. Stephanie puts $30,000 in a savings account that pays 6% interest. Steve has to pay the 50% capital gains tax, Stephanie is in the 35% tax bracket. The inflation rate was 2%. Who had the higher before-tax real gain and who had the higher after-tax real gain?

A) Steve had both the higher before-tax real gain and the higher after-tax real gain.

B) Steve had the higher before-tax real gain but Stephanie had the higher after-tax real gain.

C) Stephanie had the higher before-tax real gain but Steve had the higher after-tax real gain.

D) Stephanie had both the higher before-tax real gain and the higher after-tax real gain.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price level falls if either

A) money demand or money supply shifts rightward.

B) money demand shifts rightward or money supply shifts leftward.

C) money demand shifts leftward or money supply shifts rightward.

D) money demand or money supply shifts leftward.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over time both real GDP and the price level have trended upward. Which of these trends would the classical dichotomy say could be explained by an upward trend in the money supply?

A) both the upward trend in real GDP and the upward trend in the price level

B) the upward trend in real GDP but not the upward trend in the price level

C) the upward trend in the price level but not the upward trend in real GDP

D) neither the upward trend in the price level nor the upward trend in real GDP

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If velocity and output were nearly constant, then

A) the inflation rate would be much higher than the money supply growth rate.

B) the inflation rate would be about the same as the money supply growth rate.

C) the inflation rate would be much lower than the money supply growth rate.

D) any of the above would be possible.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S., taxes on capital gains are computed using

A) nominal gains. This is one way by which higher inflation discourages saving.

B) nominal gains. This is one way by which higher inflation encourages saving.

C) real gains. This is one way by which higher inflation discourages saving.

D) real gains. This is one way by which higher inflation encourages saving.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, long-run equilibrium is obtained when the quantity demanded and quantity supplied of money are equal due to adjustments in

A) nominal interest rates.

B) real interest rates.

C) the price level.

D) the money supply.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

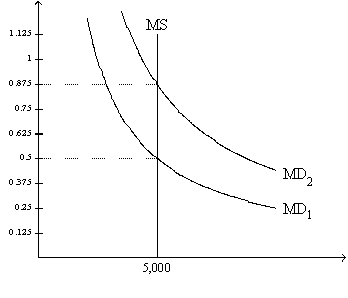

Figure 12-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.

-Refer to Figure 12-2. Which of the following events could explain a shift of the money-demand curve from MD1 to MD2?

-Refer to Figure 12-2. Which of the following events could explain a shift of the money-demand curve from MD1 to MD2?

A) an increase in the value of money

B) a decrease in the price level

C) an open-market purchase of bonds by the Federal Reserve

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

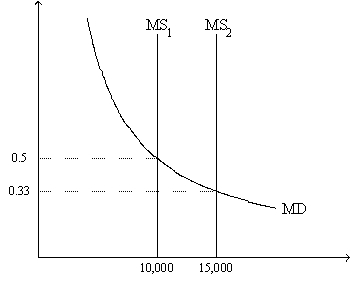

Figure 12-3. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.

-Refer to Figure 12-3. What quantity is measured along the vertical axis?

-Refer to Figure 12-3. What quantity is measured along the vertical axis?

A) the price level

B) the velocity of money

C) the value of money

D) the quantity of money

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetary neutrality means that a change in the money supply

A) does not change real variables. Most economists think this is a good description of the economy in the short run and in the long run.

B) does not change real variables. Most economists think this is a good description of the economy in the long run but not the short run.

C) does not change nominal variables. Most economists think this is a good description of the economy in the short-run and the long run.

D) does not change nominal variables. Most economists think this is a good description of the economy in the long run but not the short run.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The nominal interest rate is 6 percent and the real interest rate is 2 percent. What is the inflation rate?

A) 3 percent.

B) 4 percent.

C) 8 percent.

D) 12 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 384

Related Exams