B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm adheres strictly to the residual dividend model,the issuance of new common stock would suggest that

A) the dividend payout ratio has remained constant.

B) the dividend payout ratio is increasing.

C) no dividends will be paid during the year.

D) the dividend payout ratio is decreasing.

E) the dollar amount of capital investments had decreased.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

One implication of the bird-in-the-hand theory of dividends is that a given reduction in dividend yield must be offset by a more than proportionate increase in growth in order to keep a firm's required return constant,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm declares a 20:1 stock split,and the pre-split price was $500,then we might expect the post-split price to be $25.However,it often turns out that the post-split price will be higher than $25.This higher price could be due to signaling effects investors believe that management split the stock because they think the firm is going to do better in the future.The higher price could also be because investors like lower-priced shares.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One advantage of dividend reinvestment plans is that they enable investors to avoid paying taxes on the dividends they receive.

B) If a company has an established clientele of investors who prefer a high dividend payout,and if management wants to keep stockholders happy,it should not adhere strictly to the residual dividend model.

C) If a firm adheres strictly to the residual dividend model,then,holding all else constant,its dividend payout ratio will tend to rise whenever its investment opportunities improve.

D) If Congress eliminates taxes on capital gains but leaves the personal tax rate on dividends unchanged,this would motivate companies to increase their dividend payout ratios.

E) Despite its drawbacks,following the residual dividend model will tend to stabilize actual cash dividends,and this will make it easier for firms to attract a clientele that prefers high dividends,such as retirees.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a firm uses the residual dividend model to set dividend policy,then dividends are determined as a residual after providing for the equity required to fund the capital budget.Under this model,the better the firm's investment opportunities,the lower its payout ratio will be,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm follows the residual dividend model,then a sudden increase in the number of profitable projects would be likely to lead to a reduction of the firm's dividend payout ratio.

B) The clientele effect explains why so many firms change their dividend policies so often.

C) One advantage of adopting the residual dividend model is that this policy makes it easier for a corporation to attract a specific and well-identified dividend clientele.

D) New-stock dividend reinvestment plans are similar to stock dividends because they both increase the number of shares outstanding but don't change the firm's total amount of book equity.

E) Investors who receive stock dividends must pay taxes on the value of the new shares in the year the stock dividends are received.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Becker Financial recently declared a 2-for-1 stock split.Prior to the split,the stock sold for $60 per share.If the firm's total market value is unchanged by the split,what will the stock price be following the split?

A) $30.60

B) $29.10

C) $30.00

D) $24.30

E) $23.70

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

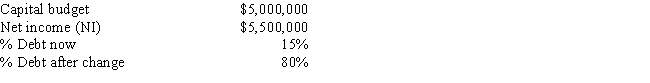

Purcell Farms Inc.has the following data,and it follows the residual dividend model.Currently,it finances with 15% debt.Some Purcell family members would like for the dividend payout ratio to be increased.If Purcell increased its debt ratio,which the firm's treasurer thinks is feasible,by how much could the dividend payout ratio be increased,holding other things constant?

A) 68.5%

B) 60.9%

C) 60.3%

D) 63.8%

E) 59.1%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

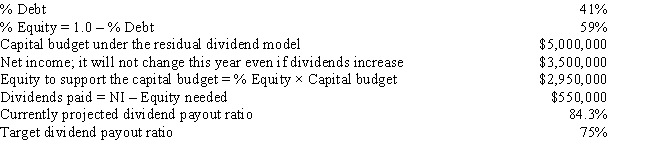

Multiple Choice

Walter Industries is a family owned concern.It has been using the residual dividend model,but family members who hold a majority of the stock want more cash dividends,even if that means a slower future growth rate.Neither the net income nor the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio.By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio?

A) -$3,516,949

B) -$4,044,492

C) -$3,727,966

D) -$4,079,661

E) -$2,919,068

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a company has a 2-for-1 stock split,its stock price should roughly double.

B) Capital gains earned on shares repurchased are taxed less favorably than dividends,which is why companies typically pay dividends and avoid share repurchases.

C) Very often,a company's stock price will rise when it announces that it plans to commence a share repurchase program.Such an announcement could lead to a stock price decline,but this does not normally happen.

D) Stock repurchases increase the number of outstanding shares.

E) The clientele effect is the best explanation for why companies tend to vary their dividend payments from quarter to quarter.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

New Orleans Builders Inc.has the following data.If it follows the residual dividend model,what is its forecasted dividend payout ratio?

A) 46.80%

B) 30.00%

C) 43.20%

D) 32.00%

E) 40.00%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

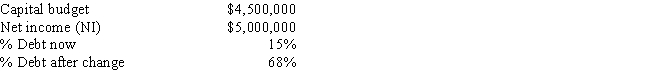

Multiple Choice

Clark Farms Inc.has the following data,and it follows the residual dividend model.Currently,it finances with 15% debt.Some Clark family members would like for the dividends to be increased.If Clark increased its debt ratio,which the firm's treasurer thinks is feasible,by how much could the dividend be increased,holding other things constant?

A) $2,957,400

B) $2,718,900

C) $1,860,300

D) $2,385,000

E) $1,955,700

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One disadvantage of dividend reinvestment plans is that they increase transactions costs for investors who want to increase their investment in the company.

B) One advantage of dividend reinvestment plans is that they enable investors to postpone paying taxes on the dividends credited to their account.

C) Stock repurchases can be used by a firm that wants to increase its debt ratio.

D) Stock repurchases make sense if a company expects to have a lot of profitable new projects to fund over the next few years,provided investors are aware of these investment opportunities.

E) One advantage of an open market dividend reinvestment plan is that it provides new equity capital and increases the shares outstanding.

G) All of the above

Correct Answer

verified

Correct Answer

verified

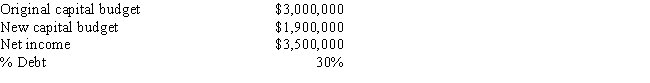

Multiple Choice

Whitman Antique Cars Inc.has the following data,and it follows the residual dividend model.Some Whitman family members would like more dividends,and they also think that the firm's capital budget includes too many projects whose NPVs are close to zero.If Whitman reduced its capital budget to the indicated level,by how much could dividends be increased,holding other things constant?

A) $521,700

B) $404,200

C) $493,500

D) $484,100

E) $470,000

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Historically,the tax code has encouraged companies to pay dividends rather than retain earnings.

B) If a company uses the residual dividend model to determine its dividend payments,dividend payout will tend to increase whenever its profitable investment opportunities increase relatively rapidly.

C) The more a firm's management believes in the clientele effect,the more likely the firm is to adhere strictly to the residual dividend model.

D) Large stock repurchases financed by debt tend to increase expected earnings per share,but they also tend to increase the firm's financial risk.

E) A dollar paid out to repurchase stock has the same tax benefit as a dollar paid out in dividends.Thus,both companies and investors should be indifferent between distributing cash through dividends and stock repurchase programs.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm uses the residual dividend model to set dividend policy,then dividends are determined as a residual after providing for the equity required to fund the capital budget.Under this model,the higher the firm's debt ratio,the lower its payout ratio will be,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

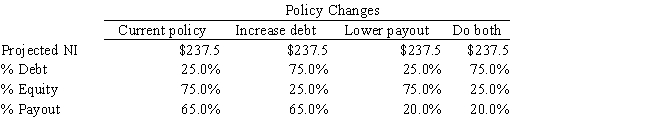

Del Grasso Fruit Company has more positive NPV projects than it can finance under its current policies without issuing new stock,but its board of directors had decreed that it cannot issue any new shares in the foreseeable future.Your boss,the CFO,wants to know how the capital budget would be affected by changes in capital structure policy and/or the target dividend payout policy.You obtained the following data,which shows the firm's projected net income (NI) ,its current capital structure and dividend payout policies,and three possible new policies.Projected net income for the coming year will not be affected by a policy change.How much larger could the capital budget be if (1) the target debt ratio were raised to the indicated amount,other things held constant, (2) the target payout ratio were lowered to the indicated amount,other things held constant,or (3) the debt ratio and dividend payout were both changed by the indicated amounts?

A) 221.7;142.5;649.2

B) 277.1;129.7;525.8

C) 166.3;146.8;506.4

D) 219.5;172.4;616.7

E) 268.2;108.3;694.6

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

D.Paul Inc.forecasts a capital budget of $700,000.The CFO wants to maintain a target capital structure of 45% debt and 55% equity,and she also wants to pay a dividend of $350,000.If the company follows the residual dividend model,how much income must it earn,and what will its dividend payout ratio be?

A) $742,350;47.15%

B) $639,450;54.73%

C) $801,150;43.69%

D) $735,000;47.62%

E) $911,400;38.40%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT CORRECT?

A) Stock repurchases can be used by a firm as part of a plan to change its capital structure.

B) After a 3-for-1 stock split,a company's price per share should fall,but the number of shares outstanding will rise.

C) Investors may interpret a stock repurchase program as a signal that the firm's managers believe the stock is undervalued,or,alternatively,as a signal that the firm does not have many good investment opportunities.

D) A company can repurchase stock to distribute a large one-time cash inflow,say from the sale of a division,to stockholders without having to increase its regular dividend.

E) Stockholders pay no income tax on dividends if the dividends are used to purchase stock through a dividend reinvestment plan.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 75

Related Exams